Protecting Your Portfolio

October 10, 2025

Protecting Your Portfolio From Loss

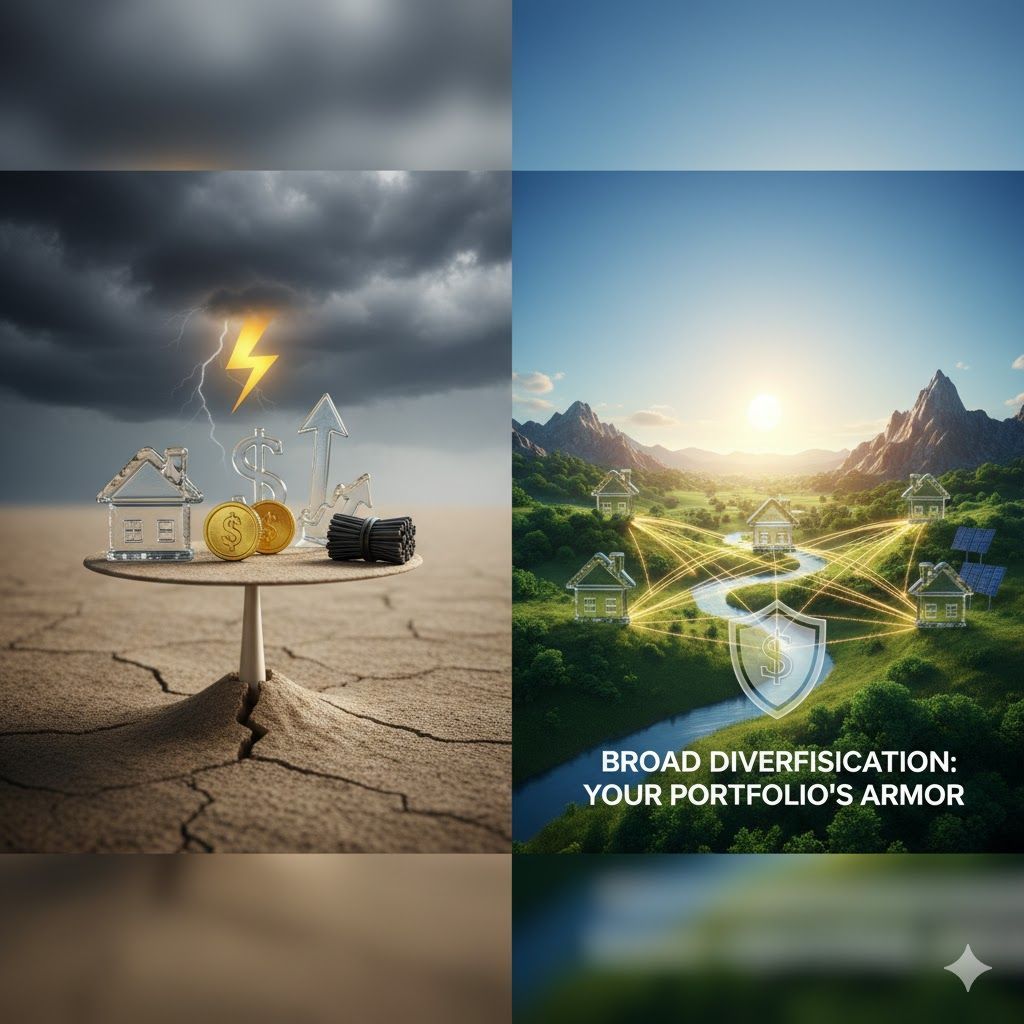

To achieve portfolio safety and potentially enhance long-term returns, investors should prioritize broad diversification across various industries, asset classes, and geographical regions.

This strategy helps mitigate risks associated with over-concentration in any single investment or market segment. By spreading investments, a portfolio is better positioned to weather market fluctuations and economic uncertainties.

Key areas for diversification include:

- Asset Classes: Distribute investments among different types of assets like stocks, bonds, cash, real estate, and commodities.

- Industries/Sectors: Invest in a variety of sectors (e.g., technology, healthcare, finance) to avoid over-reliance on any specific industry's performance.

- Geographical Regions: Include domestic and international investments to capitalize on growth in different economies and protect against region-specific risks.

Insights

- While diversification reduces asset-specific risk, it does not eliminate systematic or market risk.

- Popular methods for diversifying include mutual funds and exchange-traded funds (ETFs) which offer exposure to a broad range of assets.